Grasping the Art of Bargaining Lower Prices on Cars And Truck Leasing Agreements Like a Pro

In the realm of auto leasing contracts, the ability to negotiate reduced prices can considerably influence the total cost and regards to your lease. It needs a strategic strategy, knowledge of the marketplace, and a specific degree of skill. As consumers, we usually ignore the power we keep in shaping the terms of our arrangements, thinking that the terms provided are non-negotiable. Grasping the art of discussing reduced prices on automobile leases can not only save you money yet additionally provide you with a much better understanding of the leasing procedure as a whole.

Comprehending Your Leasing Arrangement

Devaluation is the difference between the cars and truck's first worth and its anticipated value at the end of the lease, separated by the lease term. Inevitably, a clear understanding of your leasing agreement outfits you with the expertise required to discuss extra successfully and safeguard a desirable offer.

Researching Market Rates and Trends

To properly discuss reduced prices on car leasing arrangements, it is vital to perform comprehensive research on current market prices and fads. Researching market prices involves comparing the expenses of comparable lease contracts supplied by different dealers or renting companies. By understanding the typical rates on the market, you equip yourself with useful knowledge that can be utilized as utilize throughout settlements.

Furthermore, staying informed regarding market fads is necessary. Factors such as the demand for certain automobile models, the state of the economy, and even the moment of year can affect leasing prices. When prices are likely to be much more positive and time your settlements appropriately., keeping track of these trends can help you anticipate.

On the internet sources, sector publications, and even discussions with industry specialists can provide valuable understandings right into current market rates and trends. By equipping yourself with this knowledge, you can approach negotiations with confidence and enhance your possibilities of safeguarding a reduced price on your car renting arrangement.

Leveraging Your Credit Rating

By understanding how your credit rating score influences leasing prices and terms, you can tactically take advantage of this monetary facet to potentially bargain much better terms on your cars and truck leasing arrangement. When identifying the interest price and terms they supply you, your credit report score offers as an important aspect that leasing companies consider. A higher credit report typically signifies to loan providers that you are a lower-risk customer, which can result in more desirable leasing terms. To utilize your credit history efficiently, start by examining your credit scores record for any read type of mistakes that might be negatively impacting your score. Take steps to boost your credit rating by making prompt payments, maintaining bank card balances reduced, and preventing opening new lines of credit score prior to participating in an auto leasing contract. By showing responsible credit scores actions, you can boost your working out setting and potentially protect a reduced rate of interest and much more beneficial terms on your cars and truck lease.

Working Out With Confidence and Understanding

With a thorough understanding of the auto leasing process and equipped with expertise of market prices, you can with confidence work out positive terms for your lease agreement. Familiarize on your own with typical leasing terms such as money factor, residual worth, and capitalized price to guarantee you are well-appointed to review these aspects with the leasing agent.

Additionally, be prepared to leave if the terms are not to your taste. Demonstrating a readiness to explore various other options can usually prompt the leasing firm to supply extra appealing prices to safeguard your business. Furthermore, utilize any kind of commitment programs or price cuts you might be qualified for to even more improve your negotiating position.

Checking Out Alternate Leasing Options

One more choice to check out is a lease expansion. If you more than check these guys out happy with your present car and its condition, prolonging the lease can be a basic way to proceed driving the exact same cars and pop over here truck without the inconvenience of returning it and discovering a brand-new one. Furthermore, you can take into consideration a lease buyout where you acquire the automobile at the end of the lease. This can be valuable if the car has actually retained its value well and you wish to keep it for the long-term.

Conclusion

The leasing agreement serves as a lawfully binding contract between you, as the lessee, and the renting company, detailing the terms of the lease, consisting of month-to-month payments, mileage limits, upkeep obligations, and possible charges. Depreciation is the difference between the vehicle's first value and its expected value at the end of the lease, separated by the lease term. Researching market rates involves comparing the costs of similar lease arrangements used by different car dealerships or leasing firms (lincoln lease).By recognizing how your credit report rating influences leasing prices and terms, you can tactically utilize this monetary element to possibly work out far better terms on your vehicle leasing contract. In a lease takeover, you think the continuing to be lease term and payments of someone looking to get out of their lease early

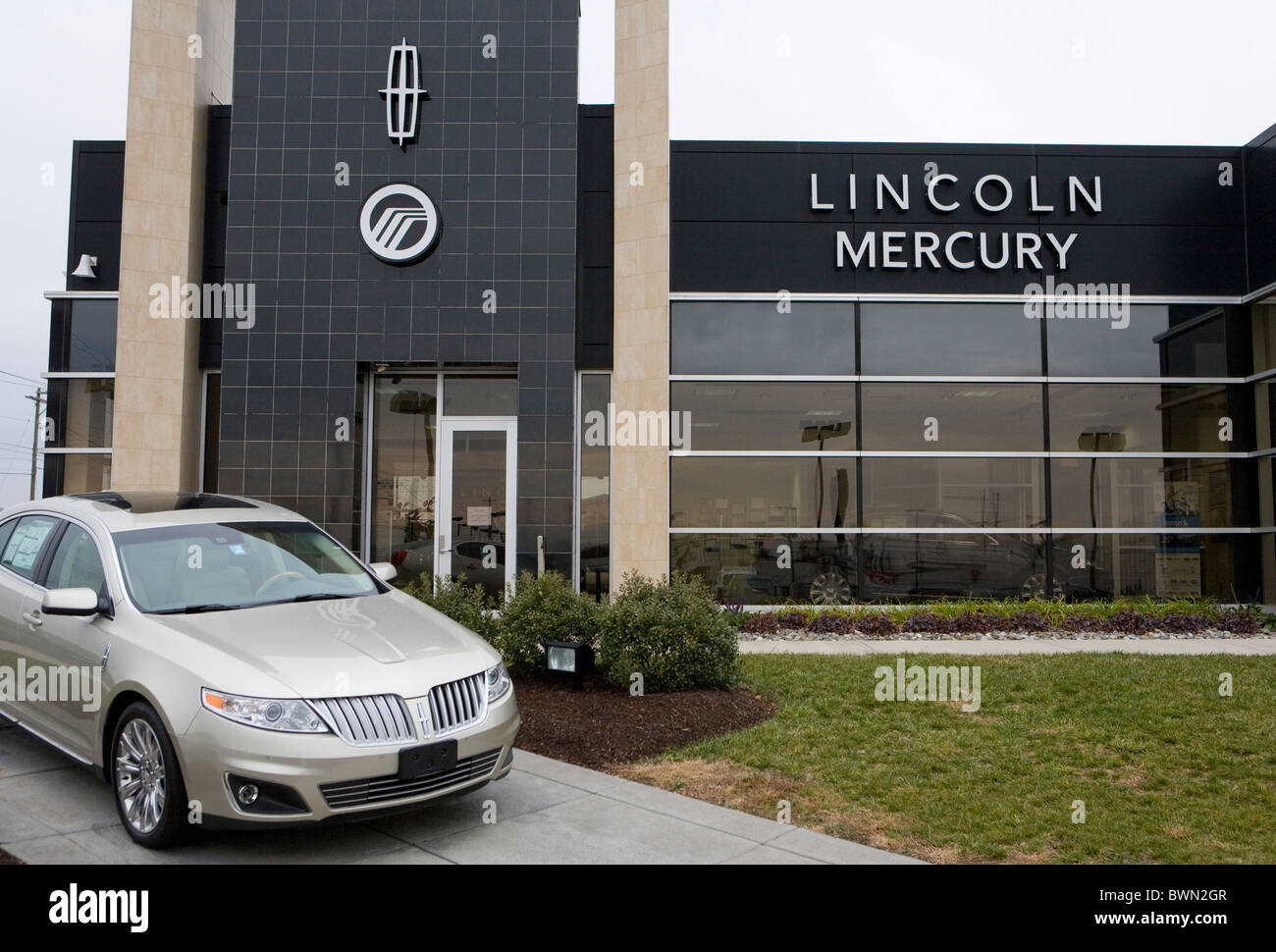

Comments on “Discover Your Perfect Lincoln Lease at Varsity Lincoln Dealerships”